Municipal Budget

Municipalities are required to prepare a balanced budget each year, and we cannot incur a deficit to fund day-to-day operations. In order to balance the budget, a careful analysis must be done regarding the level of service required to meet the expectations and needs of the community balanced against realistic taxation and user fee levels.

The Municipal budget is broken into two types of expenses - Operating and Capital. The Operating budget consists of the regular expenses that are required to keep things running smoothly day in and day out. These are things like waste collection, snow removal, parks maintenance, and provision of clean water. The Capital budget includes one-time projects or purchases, and can include road projects, new facilities, new equipment/machinery/vehicles, and replacement of aging infrastructure.

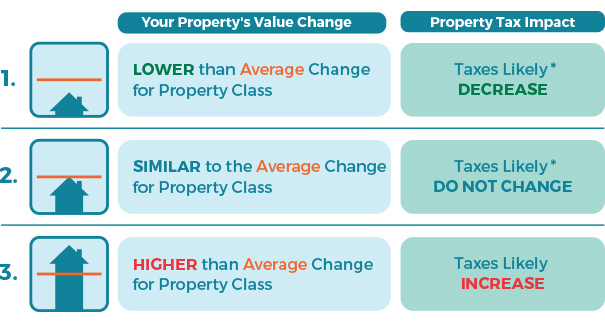

How does my property assessment affect my property taxes?

A common misconception is that a significant change in your assessed value will result in a significant change in your property taxes. The most important factor is how your assessed value has changed relative to the average change for your property class in your municipality. BC Assessment has lots of good information on assessments and property taxes.